There’s no denying that the fashion landscape has shifted over the past decade, with more and more brands exploring circular services and business models. This has been particularly pronounced in the outdoor category, a trend that’s reflected in our latest industry circularity study. In this article, we unpack the findings, discuss why the sector consistently outperforms the rest and explore what the wider industry can learn from its approach.

The state of circularity in fashion

Keeping a close eye on how markets, companies, supply chains and customers are responding to regulatory and consumer pressure for circularity is vital – both to measure progress on sustainability and to help us understand how we can best support our clients. That’s why Bleckmann conducts an annual survey of the apparel and lifestyle market to see how brands in different categories are evolving in line with the changing business landscape.

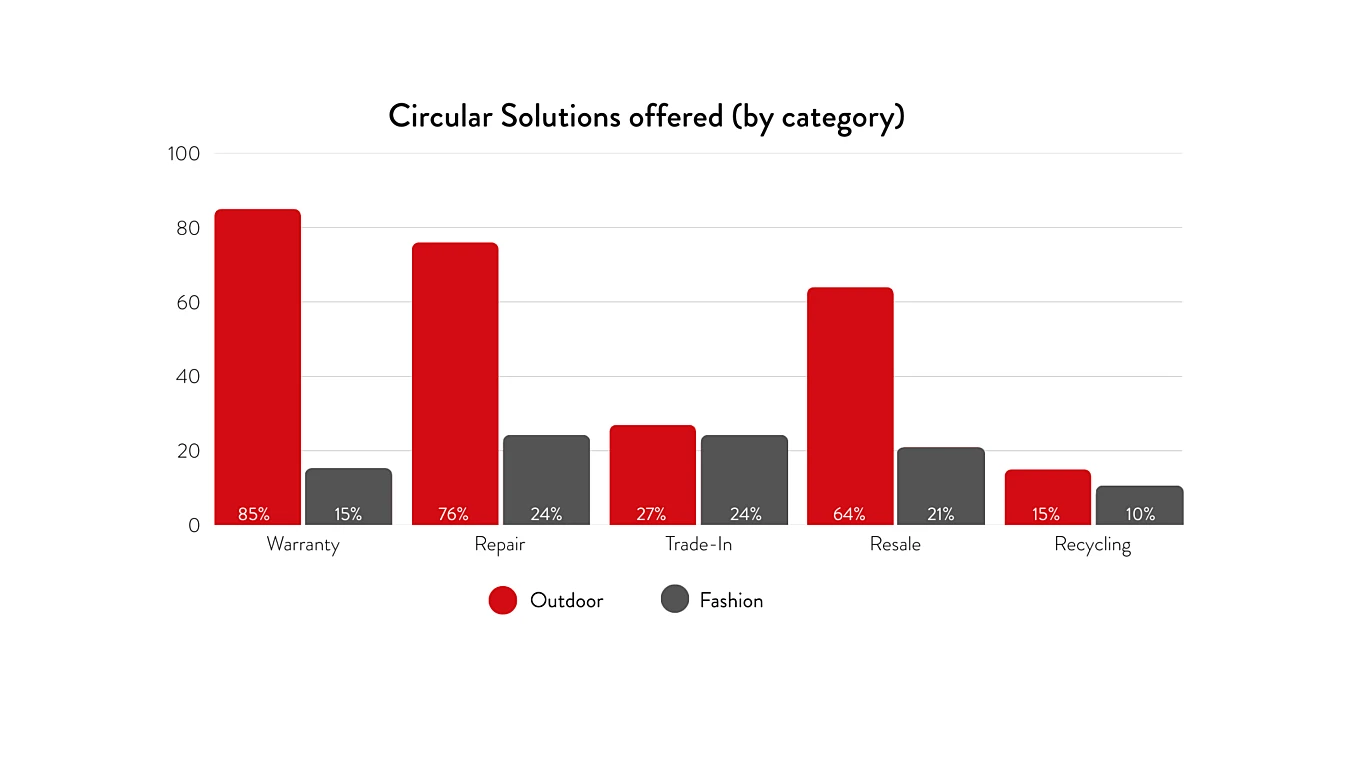

This year, we looked at 75 brands to find out what circular services they offer their customers. This research revealed that more brands across categories are exploring circular services, indicating that companies are open to exploring new ideas beyond traditional value creation models. However, outdoor apparel brands are significantly further ahead, offering more circular programmes and services than fashion brands in all areas assessed.

What services are brands providing?

The survey focused on five specific circular services, assessing each brand’s ‘circularity buy-in’ based on the total number of services offered:

Warranty

An assurance that a company will repair or replace a product that develops a defect within a specified period after purchase. This usually covers manufacturer defects.

Customer repair

By providing spare parts, companies can enable customers to repair products themselves. Brands can also offer repair services if the fault was caused by the customer or occurred outside the warranty period. Both options help to keep products in use for longer.

Trade-in/collection

These services include any programme or incentive scheme designed to encourage customers to return a brand’s products to them at the end of their use. These products may be sent to the brand itself or to a partner that will extend their usable life.

Resale

There are many ways in which brands can incentivise the resale of used products, including a branded resale programme (either in-store or online), authenticated peer-to-peer reselling or a strategic resale partnership between the brand and a resale marketplace.

Recycling

Some brands facilitate the recycling of end-of-life textiles, helping to reduce the industry’s reliance on virgin materials. We focused on public partnerships between brands and textile-to-textile recyclers. This reflects a public commitment to investing in supply chain circularity – from design for recycling to expanding the market for recycled fibres.

Outdoor: An outperforming category

The results of this year’s study are shown below. As you can see, brands in the outdoor category performed significantly better than fashion brands across all circular services. This was particularly evident when you look at warranty and repair services, with 85% of outdoor brands offering warranties and 76% offering repair services. This contrasts with 57% and 24% of fashion brands offering the same services. So, why does outdoor outperform?

Durability, quality and confidence

One potential reason for the superior performance of outdoor brands is customer expectations. Often, the main reason why shoppers choose one outdoor product over another is that it will help them stay dryer, warmer, cooler, or safer than another. Performance and durability are key, which is why the industry has a strong culture of standing by its products. This is reflected in the high proportion of brands that offer warranties.

This focus on durability has led to higher quality expectations. For example, NEMO Equipment is an outdoor gear brand that makes sleeping pads, tents, sleeping bags and other equipment. They’re so confident of the quality of their products that they offer a lifetime warranty. As stated on the NEMO website: “All NEMO products carry a lifetime warranty against defects in workmanship and materials to the original owner, with proof of purchase from an authorised NEMO dealer.” This commitment to quality and durability isn’t reflected in the same way in the wider fashion industry, where lifetime warranties are rare.

Extending product life further

Both warranty and customer repair are essential to keep products and materials in use. While warranties only cover what is within the control of the brand and its supply chain, NEMO offers customers access to expert repair services. The brand also sells spare parts so that customers can repair products themselves. This hands-on approach to repair helps keep products out of landfill and builds brand loyalty with eco-conscious customers.

In addition, providing these services can facilitate compliance with upcoming legislation. For example, the European Union’s Ecodesign for Sustainable Products Regulation (ESPR) sets minimum design standards for recyclability, durability, reusability and repairability for all products sold in the EU. Meanwhile, extended producer responsibility (EPR) in the EU makes brands more accountable for product life cycles – encouraging holistic circularity practices. Brands outside the outdoor category have much to learn from this approach.

Exploring trade-in and resale

Before you can adopt a circular business model, it’s important to understand how a circular supply chain differs from a linear one – and where brands may need to change their practices to adapt. In a circular business model, products aren’t sourced from factories but from customers who are no longer using the products that they bought. One common example of this type of sourcing in the outdoor category is collection or trade-in schemes. Brands use these approaches to get their products back so they can be inspected, cleaned, repaired and resold.

Brands in the outdoor industry started to resell their pre-loved products in earnest around 2018. This trend, which started mainly with pilot projects, has slowly evolved into a broader cultural shift for brands and their customers – setting new expectations for what outdoor brands can offer. This gradual process can serve as a blueprint for fashion brands looking to enhance their own circular buy-in. By starting small and learning from the results of pilot projects, you can ensure that your resale programmes are the right fit for your customers.

Several brands in the outdoor industry now have trade-in programmes where customers can send in their old items in exchange for a voucher. Some brands have in-store collection points, while others also offer online programmes. Patagonia, The North Face and Arc’teryx, for example, allow customers in the US to mail in items or drop them off at stores. These items are then repaired and used in the brand’s resale programmes. Brands can manage trade-ins in a variety of ways. Some only offer discounts on new items, while others also offer discounts on their used products. The quality requirements for returned garments also vary.

Facilitating material reuse

Another key aspect of circularity in the fashion industry is textile-to-textile recycling. This category had the lowest engagement rate of all circular services across the industry, with each sector facing its own unique challenges.

Outdoor brands and fashion brands use textile-to-textile recycling in different ways. Outdoor garments and accessories often contain more complex materials – as well as lower volumes of materials – which makes recycling more difficult. This means that recycling is more likely to be seen as a final step in the circular process, with the emphasis on reuse and repair first. Some examples of textile recycling partnerships include Arc’Teryx with Ambercycle, Patagonia with Eastman and Jeplan, Trex with REI Co-op, Houdini with Teijin and The North Face with NREL.

Fashion brands, meanwhile, face their own challenges. It’s often the case that the rapid cycle of new styles means that there is excess inventory that could be beneficially recycled into new fibres as an end-of-life strategy. This means that there is potentially a huge reserve of material for recycling, but brands need to act with care. The largest impact factor for a textile brand is in product creation, so producing a surplus of garments that are simply recycled will do little to improve a brand’s overall environmental impact. Therefore, while textile recycling can be a critical pathway to developing a circular business model in fashion, it must be accomplished with complete transparency and a strong awareness of the potential impacts. Some examples of major brand partnerships include H&M’s work with Syre and Infinited Fiber, as well as Zara’s collaboration with Circ, Ambercycle and Cycora.

Customers and regulators drive progress on circularity

As we continue to develop our circular offering within Bleckmann, it’s vital to stay aware of the market’s attitude to circularity and where it’s heading. More and more brands are investing in the various circular services required to create a circular economy, particularly sectors such as the outdoor industry that are being driven by strong customer tailwinds.

But what we’re also seeing is that the wider fashion industry is beginning to be affected by similar tailwinds, from multiple sources. For example, circularity legislation in Europe and a growing interest in reuse among fashion customers, are shaping the market in various ways. While the outdoor sector is undoubtedly a frontrunner on circularity, this status is becoming increasingly precarious. Therefore, fashion brands could greatly benefit from the experiences of outdoor brands as they look to implement their own circular strategies.

Our role as a circular service provider and operational partner is to make this knowledge available to brands so we can support them in launching circular initiatives. By facilitating integration with the different aspects of the circular ecosystem – from collection to repair to resale and recycling – we play a key role in removing the obstacles to a circular fashion economy.