Fashion is in the midst of a profound revaluation. Once dismissed as an afterthought, second-hand clothing has emerged as one of the defining growth stories of the decade. What was once tied to charity shops and stigma is now bound up with digital marketplaces, celebrity endorsements and shifting cultural ideals. Buying preloved is no longer a compromise; it is a marker of creativity, sustainability and smart consumer choice.

The numbers tell part of the story, but the real shift is cultural. A generation raised on fast fashion has turned its gaze toward slower cycles, where garments hold value beyond a single season and style is expressed through individuality rather than volume. Platforms, influencers and policies are accelerating this momentum, but the demand is rooted in consumers themselves: in their desire for affordability during uncertain times, for authenticity in an age of mass production, and for responsibility in a climate-constrained world.

Second-hand fashion is now reshaping how clothes are made, sold and valued. Its rise is not just about extending the life of garments but about redefining what it means for fashion to be modern, aspirational and sustainable.

The second-hand fashion shift

The second-hand fashion market has shifted from a peripheral niche to one of the fastest-growing segments in global apparel. Once associated mainly with charity shops, thrift stores and donation bins, resale is now a mainstream economic force, underpinned by shifting consumer values, digital innovation and a growing appetite for circularity in fashion.

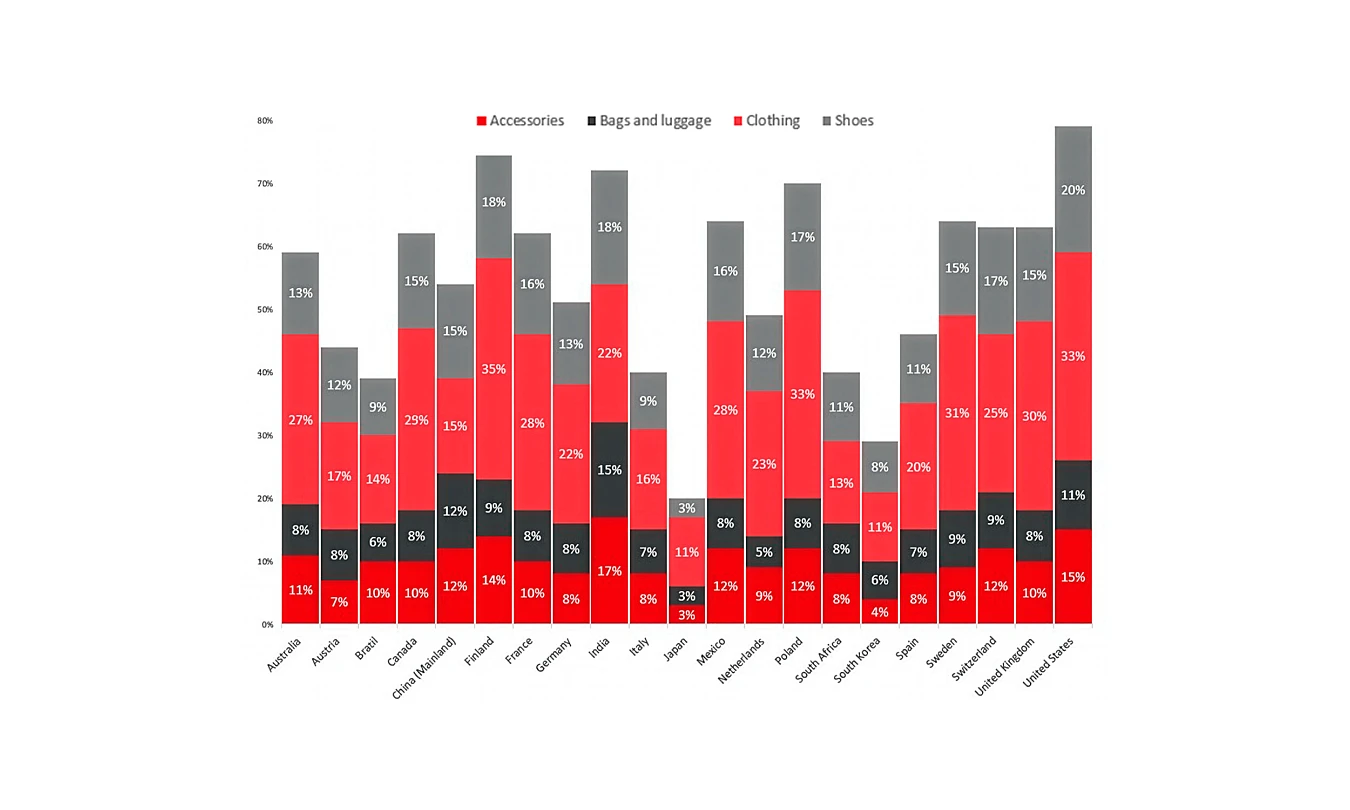

This shift is evident in consumer behaviour: today, notable percentages of the population across Europe and North America report having purchased a range of second-hand fashion goods within the past 12 months.

Percentage of respondents from selected countries who have bought the following second-hand goods in the past 12 months as of June 20251

Before examining market size, it’s worth noting that different sources define ‘resale’ or ‘second-hand’ in varying ways. Some track only clothing, others include accessories and footwear, and methodologies also differ between measuring gross merchandise volume versus retail replacement value. Because of this, estimates vary, but the trendline is clear: double-digit growth across categories and regions.

Globally, the scale is striking. Estimates from ThredUp suggest that second-hand apparel could reach USD 367 billion by 2029, growing nearly three times faster than the broader apparel industry. In the US, the single largest national market,2 resale is projected to expand to USD 74 billion by the same year, after posting a robust 14% growth in 2024 – the strongest rate seen since the pandemic recovery. 3 In Europe, platforms like Vinted and Depop are expanding rapidly, supported by a regulatory environment that increasingly favours reuse and recycling.4

This trajectory is even more remarkable when placed in historical context. The luxury resale segment, once dismissed as a threat to exclusivity, is now considered a structural part of the global luxury ecosystem. UniformMarket projects that by 2030, the second-hand luxury market will reach around USD 66 billion, 5 highlighting both its resilience and its potential to reshape consumer access to high-end goods.

A conservative estimate suggests that by 2030, the broader second-hand apparel market will reach USD 250 to 400 billion, depending on whether only apparel or apparel plus accessories are included, with luxury recommerce contributing an additional USD 50 to 70 billion.

The channels through which this growth is unfolding also mark a structural shift in fashion retail. For decades, second-hand shopping was dominated by offline outlets such as charity shops in the UK, consignment boutiques in Europe and thrift stores in the US. Now, the balance is tilting sharply toward digital. In 2024, 58% of those who bought second-hand clothing said they shopped online.6 Platforms such as eBay, ThredUp, Depop, Poshmark, Vinted and The RealReal have democratised access to preloved fashion, making it possible to browse millions of unique items with the same ease as ordering new clothes. Unsurprisingly, online resale in the US surged 23% in 2024, compared with 14% growth for the overall second-hand market, and forecasts suggest online resale will nearly double in the next five years – further evidence that digital channels are expanding much faster than brick-and-mortar thrift.7

The result is a sector that is not only outpacing traditional retail but also transforming the way value is created in fashion. Mass-market resale channels absorb the huge supply of fast-fashion and high-street apparel, extending the lifecycle of these garments, while luxury resale platforms elevate preowned items into aspirational purchases backed by authentication and trust. Together, these dynamics position second-hand fashion as a defining growth story of the 2020s – one that promises to reshape consumer expectations, retail models and even brand strategies as the decade unfolds.

These growth figures tell only part of the story. To understand why resale is expanding so rapidly, it is essential to examine the forces driving this momentum.